Fundraising going into 2026 is faster, louder, and more global than ever. Investors receive hundreds of pitches weekly, inboxes are noisier, and founders have to make their outreach sharper, smarter, and more data-driven if they want a response.

And yet one thing hasn’t changed:

Email remains the single most effective channel for investor outreach.

This guide breaks down what’s working now—subject lines that get opened, templates that get replies, and follow-up strategies that actually convert. Along the way, we’ll also highlight a modern shift most successful founders are making for 2026.

Why Email Outreach Still Works — If Done Right

A well-written outreach email does three things:

- Gets opened

- Gets read

- Gets a response or an action

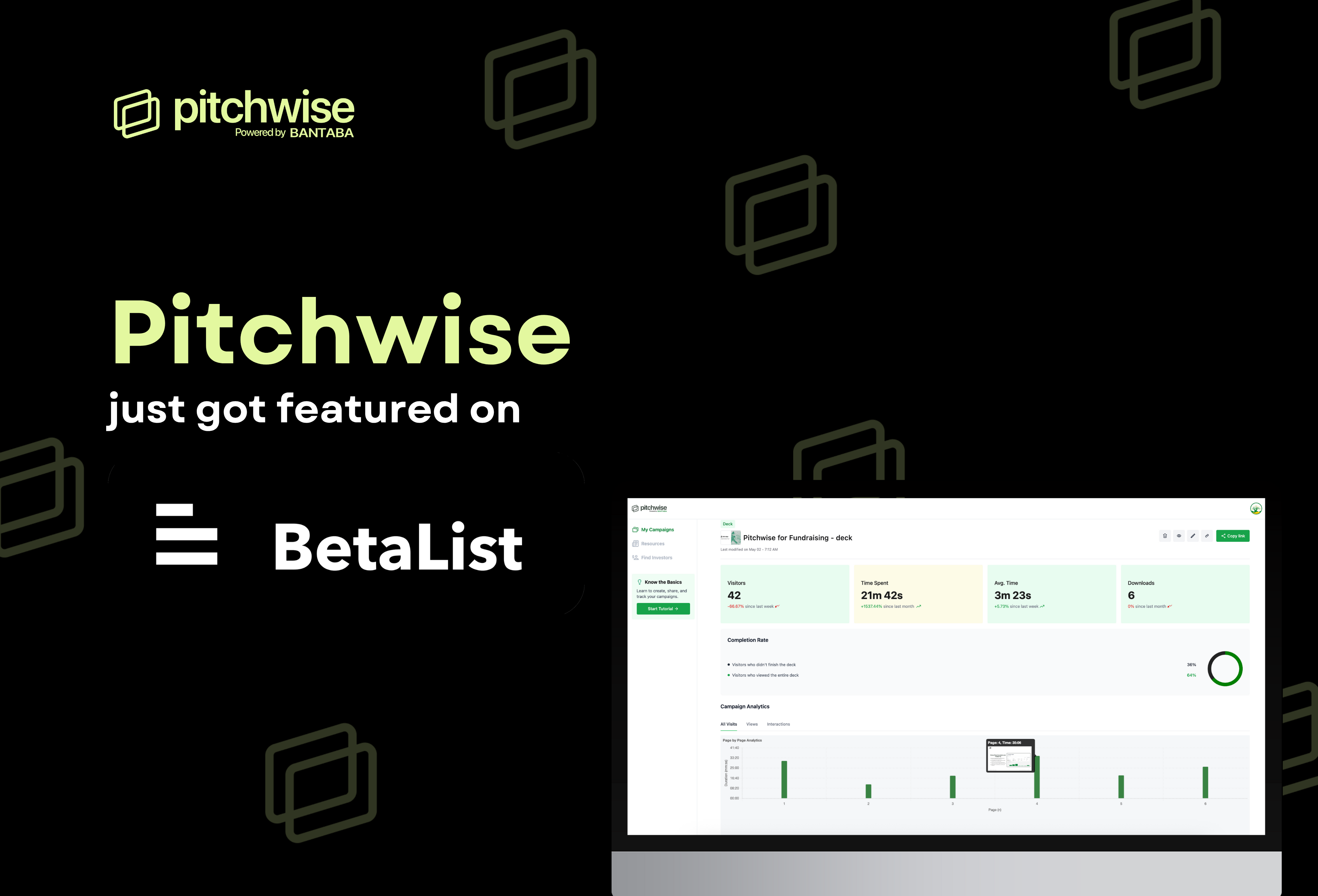

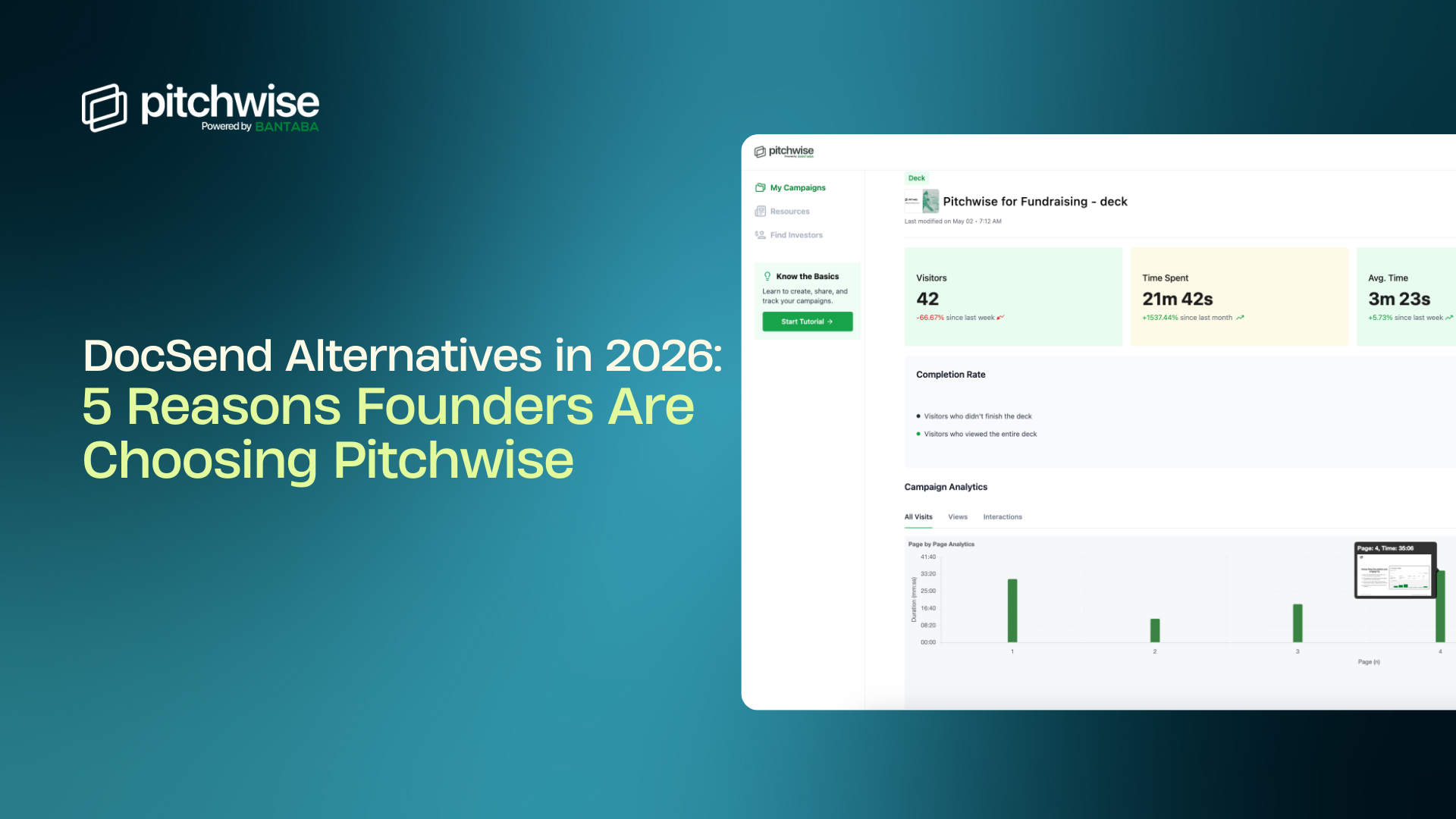

But most founders lose investors at step one, or worse, they attach a bulky PDF that never gets opened and gives them zero visibility. Attachments introduce friction: they’re heavy, unfriendly on mobile, sometimes flagged as spam, and give founders no visibility into what happened after clicking “send”. As we head into 2026, more founders are shifting to Pitchwise links, because links offer three immediate advantages that attachments can’t:

- They give founders real signals about investor interest — who opened, when they opened, and where they spent time.

- They keep the deck updated automatically, ensuring investors always see the latest version.

- They make follow-ups smarter, allowing founders to reach out based on engagement instead of guessing.

Instead of hoping a PDF gets opened, founders now send a quick Pitchwise link and instantly know whether an investor is leaning in or simply not the right fit. That clarity fundamentally changes the outreach game.

Proven Subject Lines That Would Get Opens in 2026

A good subject line is short, relevant, and curiosity-driven. Here are top-performing formats:

1. The Traction First Line: “$120k MRR in 9 months — Intro?”

2. The Personalisation Line: “Following your point on supply-chain fintech at Web Summit”

3. The Warm Signal: “Referred by ‘xyz’—2-min intro”

4. The Insight Hook: “We solved the exact churn problem you tweeted about.”

5. The Data-Backed Ask: “Investor fit? Quick view of our 2026 deck”

Tip: Subject lines that hint at a short, scannable email perform better than “attaching my deck”, which signals effort and risk (investors rarely open cold attachments).

2026 Outreach Templates That Get Replies

Below are modern, battle-tested templates founders can use immediately.

Template 1 — The Short, No-Scroll Email

(best for cold outreach)

Hi {{Name}},

I’m {{Founder}}, building {{startup in one line}}.

We’re solving {{problem}} for {{customer}}, and recently hit:

• {{traction metric}}

• {{growth signal}}

• {{market proof}}

Here’s a quick deck (2-min scan):

Pitchwise Link

If this aligns with your focus, I'm happy to send more context or jump on a short call.

Best,

{{Your Name}}

Why this works: It respects time and avoids attachments, and the Pitchwise link lets founders see if the investor opened the deck before following up.

Template 2 — The “Warm but Light” Intro

Hi {{Name}},

{{Mutual contact}} suggested I reach out.

We’re working on {{startup description}}, and I thought our progress might be relevant to your {{sector}} focus.

Deck here: Pitchwise link (quick read)

If helpful, I'm happy to share more.

Best,

{{Your Name}}

Why this works: Investors almost always click the link if a trusted contact is mentioned — and with Pitchwise, you’ll know when they do.

Template 3 — The “Problem First” Story Email

Hi {{Name}},

We noticed {{specific problem in their portfolio/market trend}} and built {{product}} to solve it.

Key results so far:

- {{metric}}

- {{metric}}

- {{customer proof}}

Deck (no attachments): Pitchwise link

Would love your thoughts if this fits your current thesis.

Thanks,

{{Your Name}}

Follow-Up Strategy That Would Actually Works in 2026

The biggest mistake founders make in follow-up is sending messages at the wrong time, either too early or too late, or without knowing whether the investor even looked at the deck. In 2026, smarter follow-ups would be made possible through behaviour-based signals.

If an investor opens a Pitchwise link, spends time on key slides, or shares the deck with a partner, that’s a moment worth following up on. A simple note like “Glad you had a moment to look through the deck—happy to walk through any part of it if useful” feels natural and timely.

On the other hand, if the deck hasn’t been opened after a week, the founder can send a gentle bump. If two weeks pass with no engagement at all, a polite “closing the loop” email resets the dynamic without burning bridges.

This timing works because it mirrors investor behaviour rather than guessing at it.

Smart Follow-Up Sequence (Powered by Pitchwise Signals)

Follow-Up #1 — When they open the deck

Send within 24 hours

Subject: “Glad you got a chance to view the deck”

Hi {{Name}}, saw you had a moment to review the deck — happy to send more details or walk you through any section.

Short and respectful. No pressure.

Follow-Up #2 — If they shared the deck internally

Investors only share decks they’re mildly or strongly interested in.

Subject: “Happy to provide more detail for the team”

Signals confidence without being needy.

Follow-Up #3 — If they haven’t opened the deck

Send after 5–7 days.

Hi {{Name}},

Resurfacing this in case it slipped through — here’s the deck again: Pitchwise Link

Attachments get buried. Links don’t.

Follow-Up #4 — The Closed Loop

If no response after 2 weeks:

Subject: “Happy to close the loop”

Surprisingly, this often triggers replies, especially when sent after Pitchwise shows renewed investor activity. You can also keep them on your update broadcast list and send them routine updates monthly or quarterly to remain top of mind.

The 2026 Outreach Advantage: Light, Trackable, and Action-Oriented

Email outreach still works, but the founders who succeed in 2026 are the ones who pair strong communication with actionable insight. The old approach of attaching a static deck and praying for a response is disappearing. In its place, founders are sending Pitchwise links that streamline access, reveal interest, and embed calls to action directly inside the deck.

The result? Better open rates, better follow-ups, and more investor conversations. Sign up to Pitchwise and make your fundraising smarter today: app.pitchwise.se

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)