If you’re raising in the UK (or from UK-based funds), success is often less about how many investors you reach and more about how accurately you target the right ones. Many well-known firms maintain strong public visibility but deploy very selectively at pre-seed and seed, meaning founders can spend months pursuing logos that were never realistic matches for their stage.

This list is designed to save you that time. It highlights UK-based funds that are consistently active at the earliest stages, known for engaging meaningfully with founders, and still writing new cheques in the current environment. These are the firms most likely to take first meetings seriously, lead rounds, and lean in early rather than waiting for traction to de-risk the opportunity.

1. Seedcamp

Website: https://seedcamp.com

Focus: Pre-seed, Seed (SaaS, fintech, developer tools, marketplaces)

Notable Portfolio: Wise, Revolut, Hopin, Pleo, UiPath

Typical Check: £300K–£1M

Seedcamp is widely regarded as one of the strongest early-stage partners in Europe, especially for first-time founders. They often invest before traction is obvious and place significant weight on clarity of thinking, market insight, and the founder’s ability to articulate a long-term narrative. Their investment team includes former operators who actively help founders shape positioning, refine decks, and prepare for institutional seed rounds. What sets Seedcamp apart is the power of their network: a Seedcamp-backed round frequently attracts high-quality angels and co-investors, making it much easier to build a strong syndicate. For many UK and European startups, Seedcamp is the first serious institutional validation point.

2. LocalGlobe

Website: https://localglobe.vc

Focus: Pre-seed, Seed (consumer, fintech, SaaS, marketplaces)

Notable Portfolio: Figma, Wise, Monzo, Improbable

Typical Check: £250K–£1M

LocalGlobe has built a reputation as one of the most consistently active and founder-friendly early-stage firms in the UK. They write a high volume of early cheques and are comfortable backing companies that are still refining product and positioning, as long as the underlying insight is strong. They have an especially strong track record in consumer and product-led businesses, and they tend to spot breakout companies earlier than most. Founders often describe them as intellectually honest and direct — they give real feedback, not vague encouragement. A LocalGlobe investment carries strong signalling for future UK and European investors.

3. Concept Ventures

Website: https://conceptventures.vc

Focus: Pre-seed, Seed (B2B SaaS, infrastructure, fintech, data)

Notable Portfolio: Clara, Omnea, Incident.io, Tactic

Typical Check: £200K–£750K

Concept has become one of the most respected funds in the UK for technical, product-driven founders. They move quickly, run lightweight processes, and spend serious time understanding the product and the problem rather than over-analysing vanity metrics. Their partners are particularly strong at working with founders on narrative clarity — helping translate complex technical ideas into compelling investor stories. They tend to invest at the “pre-product-market-fit but strong signal” stage, making them an excellent target for founders who have built something meaningful but are still early in commercial traction.

Other Readings: Top 11 Early-Stage Investors in the US Every Founder Should Know in 2026

4. Playfair Capital

Website: https://playfair.vc

Focus: Pre-seed, Seed (deep tech, data, marketplaces, fintech)

Notable Portfolio: Luno, Mapillary, Trezy

Typical Check: £250K–£1M

Playfair is known for backing technically ambitious companies long before they look obvious to mainstream investors. They care deeply about the quality of the thinking behind the product: defensibility, systems-level understanding, and founder depth matter more than surface-level growth. Their partners tend to engage intellectually with founders, challenging assumptions and helping refine strategy rather than simply providing capital. If you’re building something complex (infrastructure, data platforms, deep tech, or sophisticated fintech), Playfair is often one of the few UK funds that will truly “get it” early.

5. Episode 1 Ventures

Website: https://episode1.com

Focus: Pre-seed, Seed (developer tools, AI, SaaS, APIs)

Notable Portfolio: Triptease, Attest, Lickd

Typical Check: £250K–£1M

Episode 1 has carved out a niche as a strong partner for deeply technical founders. They spend more time than most funds understanding product architecture, technical decisions, and long-term defensibility. They are less interested in hype cycles and much more interested in whether what you are building can actually compound into a durable business. Founders who work with Episode 1 often highlight the quality of their questioning: you leave conversations sharper, not just funded. They are especially well-suited to developer tools, AI infrastructure, APIs, and technically complex SaaS businesses.

6. Crane Venture Partners

Website: https://crane.vc

Focus: Seed, Series A (enterprise SaaS, infrastructure, AI tooling)

Notable Portfolio: Soldo, Faculty, Polar Analytics

Typical Check: £500K–£2M

Crane is one of the strongest UK firms when it comes to enterprise SaaS and B2B business models. They tend to invest when there is already some early traction and then work closely with founders on refining go-to-market strategy, pricing, ICP definition, and sales motion. They are particularly valuable for founders selling into complex enterprise customers or regulated industries. Crane is less about big vision storytelling and more about building commercially sound, scalable businesses. If your company already has customers and you’re trying to professionalise growth, they are a very strong partner.

7. Kindred Capital

Website: https://kindredcapital.vc

Focus: Pre-seed, Seed (mission-driven tech, fintech, marketplaces)

Notable Portfolio: Paddle, Bulb, Wagestream

Typical Check: £300K–£1M

Kindred operates with a very distinct philosophy: they prioritise long-term alignment with founders over short-term financial engineering. Their “equitable venture” model is designed to ensure both sides stay aligned for the long haul. They tend to be thoughtful, patient, and highly engaged when they invest. They are particularly drawn to founders building meaningful infrastructure businesses or tackling systemic problems (fintech access, sustainability, workforce, etc.). Founders who value depth of relationship over speed of capital often find Kindred to be one of the best long-term partners in the UK ecosystem.

8. Octopus Ventures (Pre-seed & Seed)

Website: https://octopusventures.com

Focus: Pre-seed, Seed (healthtech, fintech, climate, deeptech)

Notable Portfolio: Cazoo, Elvie, ManyPets

Typical Check: £300K–£2M

Octopus is one of the largest and most influential venture platforms in the UK, and their early-stage practice is very active. They back ambitious founders building in areas where technology intersects with real-world impact: healthcare, climate, financial infrastructure, and frontier tech. Their advantage is platform depth: they can support with hiring, policy connections, later-stage capital, and long-term scaling. They are particularly useful for founders building in regulated or complex sectors where navigating external stakeholders matters as much as the product itself.

Other Readings: Top 11 Early-Stage Investors in Africa Every Founder Should Know in 2026

9. Antler (UK)

Website: https://antler.co/location/united-kingdom

Focus: Pre-seed (idea stage to early traction)

Notable Activity: Hundreds of UK startups created/invested into

Typical Check: £120K–£500K

Antler is structurally different from traditional VC. They invest in founders before the company even exists and provide a structured environment for co-founder matching, validation, and early building. Their UK operation has become increasingly active, particularly in technical founder circles. While Antler isn’t ideal for founders who already have traction and are raising a traditional seed round, it is extremely powerful for individuals at the idea stage or founders who need a strong co-founder. Many Antler-backed companies go on to raise strong follow-on rounds from top-tier UK funds.

10. Firstminute Capital

Website: https://firstminute.capital

Focus: Seed (SaaS, fintech, marketplaces, infra)

Notable Portfolio: GoCardless, Carwow, TrueLayer

Typical Check: £500K–£2M

Firstminute combines operator DNA with institutional venture discipline. The firm was co-founded by Brent Hoberman (lastminute.com), and that practical business-building perspective shows in how they work with founders. They are especially good partners for founders thinking deeply about distribution, monetisation, and scalability rather than just product innovation. They tend to invest when there is already some early evidence of demand and help founders professionalise operations, sharpen metrics, and prepare for Series A expectations.

11. Ada Ventures

Website: https://adaventures.com

Focus: Pre-seed, Seed (under-represented founders, health, climate, fintech)

Notable Portfolio: Organise, Daye, Bubble

Typical Check: £250K–£1M

Ada Ventures is one of the most intentional and structured early-stage funds in the UK. Their focus on backing under-represented founders is not marketing, it’s embedded in their sourcing, evaluation, and support process. They are highly thesis-driven, particularly around health, climate, and economic inclusion. When they invest, they tend to be very hands-on, helping founders think through early strategy, narrative, hiring, and fundraising. For founders who fit their themes, Ada often becomes more of a long-term strategic partner than just a source of capital.

How to Actually Win Fundraising Conversations in the UK (2026)

The UK early-stage ecosystem remains one of the strongest in Europe, but it has become more selective, more disciplined, and more time-constrained. Funds are still deploying. Good companies are still getting funded. But founders are increasingly being evaluated on how they run the process, not just what they’re building.

Pre-seed is still the stage where sharp insight and founder quality can secure conviction early. If you have a credible team, a real problem, and a thoughtful narrative, funds like Seedcamp, LocalGlobe, Concept, and Playfair are still willing to move before perfect traction exists. But even at pre-seed, “vision alone” is no longer enough, investors want to see evidence of momentum, learning velocity, and real engagement with users.

At seed, the bar is materially higher. Funds like Crane, Firstminute, Octopus, and Episode 1 expect to see real signals: usage patterns, customer pull, revenue logic, or defensible product depth. You don’t need perfect metrics, but you do need evidence that this is not just a good idea.

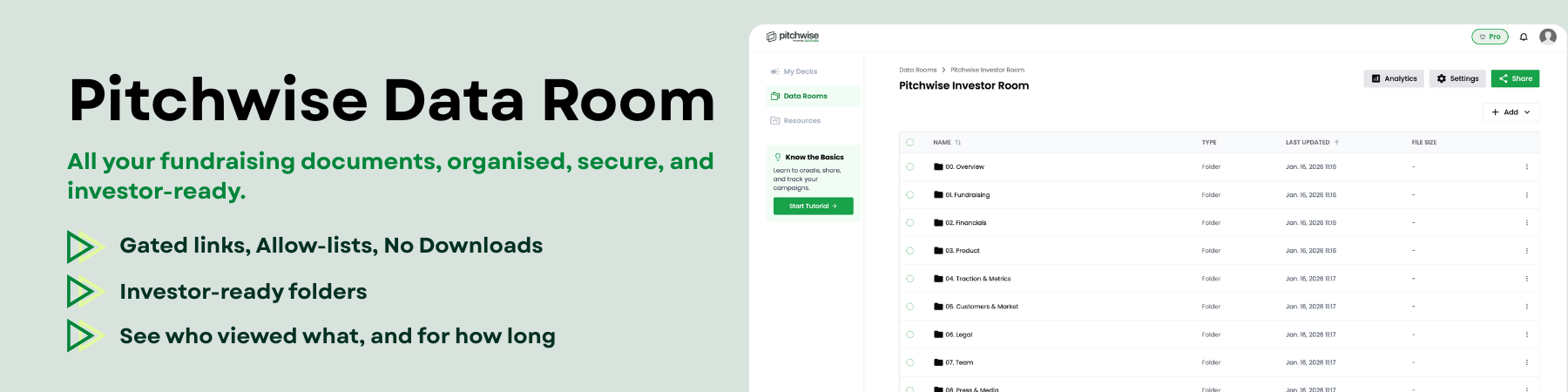

The strongest founders treat fundraising as a system. They structure their materials early. They organise their documents. They control access. They track engagement. They follow up based on signals, not hope. That’s what creates clarity, confidence, and ultimately credibility. Tools like Pitchwise exist for exactly this reason: to give founders a way to run fundraising with structure instead of chaos. Not just to track opens, but to understand intent. Not just to share files, but to control narrative. Not just to raise capital once, but to build durable infrastructure for every high-stakes conversation that follows — diligence, partnerships, commercial deals, and beyond.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)